Loan Default Prediction Project Using Machine Learning

For this project, we will be exploring publicly available data from Lending Club connects people who need money (borrowers) with people who have money (investors). Hopefully, as an investor, you would want to invest in people who showed a profile of having a high probability of paying you back. We will try to create a model that will help predict this.

We Solve this Project in 6 Phase

- Business Understanding

- Data Understanding

- Data Preparation

- Modeling

- Evaluation

- Deployment

1. Business Understanding

For this project, we will be exploring publicly available data from LendingClub.com. Lending Club connects people who need money (borrowers) with people who have money (investors). Hopefully, as an investor, you would want to invest in people who showed a profile of having a high probability of paying you back. We will try to create a model that will help predict this.

Lending Club is a US peer-to-peer lending company, headquartered in San Francisco, California. It was the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC) and to offer loan trading on a secondary market. Lending Club operates an online lending platform that enables borrowers to obtain a loan, and investors to purchase notes backed by payments made on loans. Lending Club is the world's largest peer-to-peer lending platform. Lending Club enables borrowers to create unsecured personal loans between 1,000and1,000and40,000. The standard loan period is three years. Investors can search and browse the loan listings on the Lending Club website and select loans that they want to invest in based on the information supplied about the borrower, amount of loan, loan grade, and loan purpose. Investors make money from interest. Lending Club makes money by charging borrowers an origination fee and investors a service fee.

Problem Statement: To classify if the borrower will default the loan using the borrower’s financial history. That means, given a set of new predictor variables, we need to predict the target variable as 1 -> Defaulter or 0 -> Non-Defaulter. The metric we use to choose the best model is ‘False Negative Rate’. (predictor and target variables explained later)

Import Nessecerry Libraries

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

%matplotlib inline

import warnings #remove warning messege in our project file

warnings.filterwarnings('ignore')3,2,1]

'home_ownership' = ['MORTGAGE', 'OWN', 'RENT', 'NONE', 'OTHER', 'ANY'] to [6,5,4,3,2,1]

'emp_length' = ['3 years', '10+ years', '5 years', '4 years', '6 years', '1 year','2 years', '7 years', '9 years', '8 years', '< 1 year', 'n/a'] to [int], remove string

values , n/a and change type to int

'int_rate' = remove % sign and change to int

from IPython.core.display import HTML #for good look display we import html display

from sklearn.preprocessing import StandardScaler #Convert data into Standard Scale

from sklearn.model_selection import train_test_split #for split data into tranning dataset and testing dataset

from sklearn.feature_selection import RFE #Feature selection using Recursive Feature Elimination

from sklearn.linear_model import LogisticRegression #Logistic Regresssion Algrothim

from sklearn.ensemble import RandomForestClassifier #Random Forest Classifer Algrothim

from sklearn.metrics import confusion_matrix,classification_report #for Confussion matrix and classification report

from sklearn.tree import DecisionTreeClassifier #Decision Tree Classifier Algrothims

from sklearn.neighbors import KNeighborsClassifier #KNN(K Near Neghbors Algrothims) 2. Data Understanding Phase Start.

#first data set

loan_2012_2013 = pd.read_csv("2012-2013.csv")

#second data set

loan_2014 = pd.read_csv('2014loan.csv')

#Check the type of data set.

print(type(loan_2012_2013),type(loan_2014))

#Check the shape of data set.

print((loan_2012_2013).shape,(loan_2014).shape)

Check First Data Set and Collect Information About it

#check Head of our Data frame

loan_2012_2013.head(5)

loan_2012_2013.describe(include='all')Check Missing Values in Our first Data set

#check missing values in first data set

print(loan_2012_2013.isnull().sum())

print('Rows in Data set', loan_2012_2013.shape[0],'Columns in Data set ', loan_2012_2013.shape[1])Check Second Data set

loan_2014.head()

loan_2014.info()

loan_2014.describe()check Missing Values in Second Data Set

loan_2014.isnull().sum()

loan_2014.info()3. Data Prepration

Concatenation Above Two DataSet and Create a New DataFrame is Called loandataset

loandataset = pd.concat([loan_2012_2013, loan_2014])

loandataset.head()Now Check Shape of loandataset

print('Rows in Data set', loandataset.shape[0],'Columns in Data set ', loandataset.shape[1])Missing value Treatment

loandataset.isnull().sum()Now Drop Empty Columns in loandataset

loandatasetnew=loandataset.dropna(axis=1,thresh=len(loandataset)*0.9)

loandatasetnew.shape

loandataset = loandatasetnewCheck Head Again of loandataset

loandataset.head()

loandataset['purpose'].unique()What is Target Column in loandataset ?

‘loan_status’

loandataset['loan_status'].head(10)

loandataset['loan_status'].unique()Here are 8 Type of Unique Values but we target only two type of values

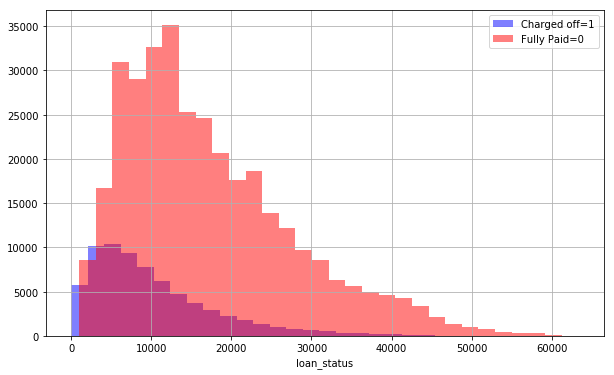

'Fully Paid' 'Charged off' We Convert Our Column values into 'Fully Paid' == 0 'Charged off' == 1 and create a new dataset is called Dataset_withBoolTarget

data_with_loanstatus_sliced = loandataset[(loandataset['loan_status']=="Fully Paid") | (loandataset['loan_status']=="Charged Off")]

di = {"Fully Paid":0, "Charged Off":1} #converting target variable to boolean

Dataset_withBoolTarget= data_with_loanstatus_sliced.replace({"loan_status": di})

Dataset_withBoolTarget['loan_status'].head(10)Now Count How many Number of fully paid and charged off values

print(Dataset_withBoolTarget['loan_status'].value_counts())

print('\n')

print("Current shape of dataset :",Dataset_withBoolTarget.shape)

Dataset_withBoolTarget.head(3)Here We Drop Some More Unrelvent Values in DataSet

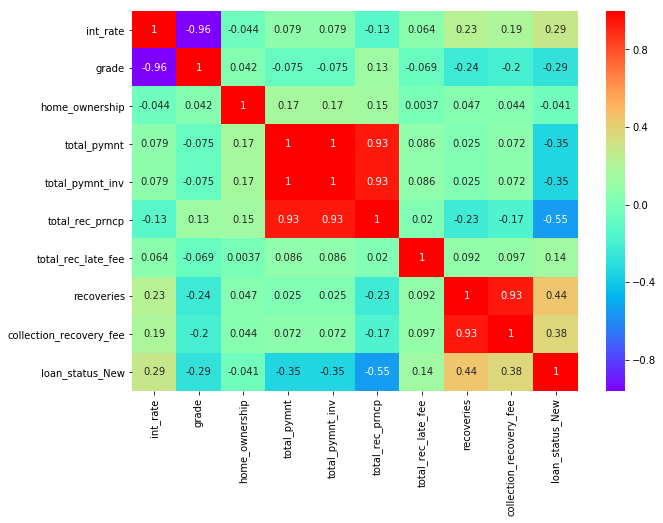

s=Dataset_withBoolTarget_corr.loc['loan_status',:]

list_week_relation_pos=s[(s <0.1) & (s> 0)]

list_week_relation_neg=s[(s > -0.1) & (s < 0)]

list_ps=list(list_week_relation_pos.index)

list_ng=list(list_week_relation_neg.index)

list_column_to_drop=list_ps+list_ng

print(len(list_column_to_drop))

#Dataset_withBoolTarget.drop(list_column_to_drop,axis=1,inplace=True)

print(Dataset_withBoolTarget.shape)

print(Dataset_withBoolTarget.head(5))Here we Create our Final DataFrame is called 'Final_data'

features = ['int_rate','grade','emp_length','home_ownership','loan_status','out_prncp','out_prncp_inv','total_pymnt','total_pymnt_inv','total_rec_prncp','total_rec_late_fee','recoveries','collection_recovery_fee','last_pymnt_amnt','purpose']

Final_data = Dataset_withBoolTarget[features] #19 features with target var

Final_data.head(10)Data Transformation

Here we do some transformation in 4 Columns of Object Type How we transformation in these columns ?

- 'grade' = ['A', 'B', 'D', 'C', 'E', 'F', 'G'] to [7,6,5,4,3,2,1]

- 'home_ownership' = ['MORTGAGE', 'OWN', 'RENT', 'NONE', 'OTHER', 'ANY'] to [6,5,4,3,2,1]

- 'emp_length' = ['3 years', '10+ years', '5 years', '4 years', '6 years', '1 year','2 years', '7 years', '9 years', '8 years', '< 1 year', 'n/a'] to [int], remove string

- values , n/a and change type to int

- 'int_rate' = remove % sign and change to int

#Data encoding

Final_data['grade'] = Final_data['grade'].map({'A':7,'B':6,'C':5,'D':4,'E':3,'F':2,'G':1})

Final_data["home_ownership"] = Final_data["home_ownership"].map({"MORTGAGE":6,"RENT":5,"OWN":4,"OTHER":3,"NONE":2,"ANY":1})

Final_data["emp_length"] = Final_data["emp_length"].replace({'years':'','year':'',' ':'','<':'','\+':'','n/a':'0'}, regex = True)

#Final_data["emp_length"] = Final_data["emp_length"].apply(lambda x:int(x))

print("Current shape of dataset :",Final_data.shape)

Final_data.head()Exploratory Data Analysis

Check Numbers of Fully Paid and Charged off Customers

Here We Check Purpose of Loan By Visualization Graph

Correlation Between all column to each other

4. Model Creation

Train test split

from sklearn.model_selection import train_test_split

data_clean.head()

#print(data_clean.isnull().sum())

data_clean['loan_status_New']=data_clean['loan_status']

data_clean.head(2)

data_clean.drop('loan_status',axis=1,inplace=True)Now we create a two different variable First X variable hold all column without target and y varable hold our target column

X = data_clean.iloc[:,:-1]

y = data_clean.iloc[:,-1]

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.3, random_state=101)Evalulate Different Models and Find Best Accuracy in Models

Here is a List of Differnet type of Algrothims we use

- Random Forest Classifer

- Decision Tree

- Logistic Regression Classifer

- K Near Neighbors

Train DataSet Using Random Forest model

from sklearn.ensemble import RandomForestClassifier

rfc = RandomForestClassifier(n_estimators=600) #create instance

rfc.fit(X_train,y_train)

Evaluation of Random Forest Model

prediction = rfc.predict(X_test)

from sklearn.metrics import confusion_matrix,classification_report,accuracy_score

print(rfc_report)

print(confusion_matrix(y_test,prediction))

print(accuracy_score(y_test, prediction, normalize=True))All Algrothims Used in Jupyter Notebook Download Notebook for this Project and Get Complete Information of this Project

Here we Check Classification Report for all above Models and Check Who's Model Give us Best Accuracy Score.

print("________________Random Forest Classification Report__________________\n")

print('RFC',rfc_report)

print('**********************************************************************\n')

print("________________Decision Tree Classification Report__________________\n")

print('DTree',dtree_report)

print('**********************************************************************\n')

print("________________Logistic Regression Classification Report__________________\n")

print('llogtt',lreport)

print('**********************************************************************\n')

print("________________K Nearest Neighbor Classification Report__________________\n")

print('knnreport',knnreport)

Conclusion

We Check all of these Model Result and than we getb Random Forest Model have a Best Accuracy other than and it's also have a Better Classification Report. So,We can say that 'The random forest model is best for our dataset'.

Download Jupyter Notebook

Thanks for Reading

Share this Project With Your Network

Random Blogs

- Variable Assignment in Python

- Why to learn Digital Marketing?

- What Is SEO and Why Is It Important?

- Top 10 Blogs of Digital Marketing you Must Follow

- Understanding LLMs (Large Language Models): The Ultimate Guide for 2025

- AI in Marketing & Advertising: The Future of AI-Driven Strategies

- Internet of Things (IoT) & AI – Smart Devices and AI Working Together

- Ideas for Content of Every niche on Reader’s Demand during COVID-19

- Types of Numbers in Python

- Top 10 Knowledge for Machine Learning & Data Science Students

Prepare for Interview

- JavaScript Interview Questions for 5+ Years Experience

- JavaScript Interview Questions for 2–5 Years Experience

- JavaScript Interview Questions for 1–2 Years Experience

- JavaScript Interview Questions for 0–1 Year Experience

- JavaScript Interview Questions For Fresher

- SQL Interview Questions for 5+ Years Experience

- SQL Interview Questions for 2–5 Years Experience

- SQL Interview Questions for 1–2 Years Experience

- SQL Interview Questions for 0–1 Year Experience

- SQL Interview Questions for Freshers

- Design Patterns in Python

Datasets for Machine Learning

- Awesome-ChatGPT-Prompts

- Amazon Product Reviews Dataset

- Ozone Level Detection Dataset

- Bank Transaction Fraud Detection

- YouTube Trending Video Dataset (updated daily)

- Covid-19 Case Surveillance Public Use Dataset

- US Election 2020

- Forest Fires Dataset

- Mobile Robots Dataset

- Safety Helmet Detection

- All Space Missions from 1957

- OSIC Pulmonary Fibrosis Progression Dataset

- Wine Quality Dataset

- Google Audio Dataset

- Iris flower dataset

- Artificial Characters Dataset

- Bitcoin Heist Ransomware Address Dataset